Reverse Factoring in Supply Chain Finance: Enhancing Liquidity with TReDS

In today’s evolving business landscape, efficient working capital management is not just a financial lever—it’s a strategic differentiator. Large corporates and public sector undertakings often walk a fine line: they need to optimise their payables without disrupting the financial health of their supplier base, especially when those suppliers are MSMEs.

Reverse factoring, enabled through platforms like TReDS (Trade Receivables Discounting System), provides a solution that addresses both ends of this equation. It allows buyers to maintain or even extend their payment cycles, while enabling suppliers to receive payments well in advance—without increasing their debt burden.

What Is Reverse Factoring in Supply Chain Finance?

In today’s supply chain environment, efficient working capital management is increasingly vital. For large corporates, the ability to extend payment terms without disrupting supplier operations has become a strategic imperative.

Reverse factoring, enabled through digital platforms such as TReDS (Trade Receivables Discounting System), offers a structured way to achieve this. Buyers gain the flexibility to manage their payables, while their suppliers—often MSMEs—receive early access to funds, ensuring liquidity and continuity without additional debt.

What is Reverse Factoring?

Reverse factoring, also known as supply chain financing or buyer-led invoice discounting, is a financial arrangement where a buyer facilitates early payment to suppliers through a financier. Unlike traditional factoring, it is the buyer who initiates the process, making it lower-risk and often more cost-effective for suppliers.

In this model:

- The buyer approves the supplier’s invoice.

- A financier pays the supplier ahead of the due date at a discounted rate.

- The buyer repays the financier on the original invoice date.

This benefits both parties. Buyers optimise their working capital, and suppliers receive payments promptly—often at financing rates tied to the buyer’s credit profile rather than their own.

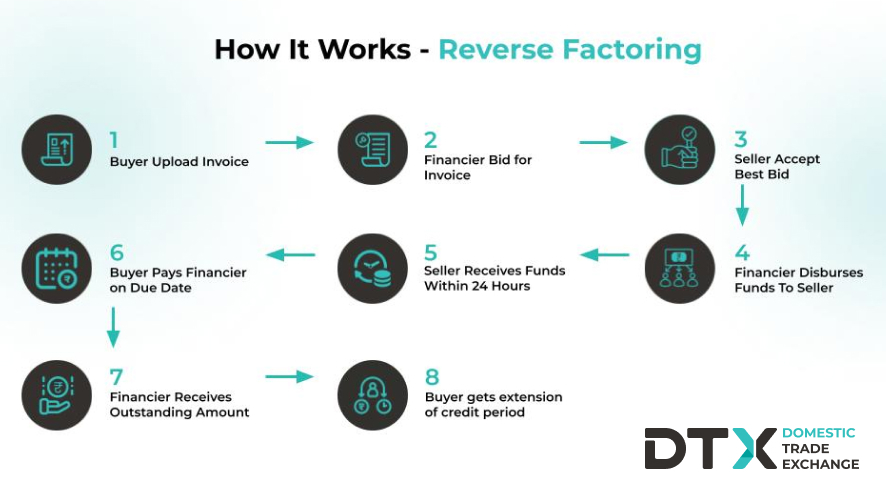

How Reverse Factoring Works on TReDS

The TReDS platform, regulated by the Reserve Bank of India, digitises and automates the entire reverse factoring process. It enables seamless interaction between buyers, suppliers, and multiple financiers within a unified ecosystem.

The process typically works as follows:

TReDS ensures full transparency, faster processing, and lower friction—making it easier for businesses to digitise and scale their supply chain finance operations.

Why Buyers are Prioritising Reverse Factoring

For large buyers, reverse factoring is no longer just a tool for vendor management—it is a working capital strategy. The ability to extend payment cycles without damaging supplier relationships allows businesses to retain cash longer, maintain operational agility, and manage liquidity more precisely.

Key benefits for buyers include:

- Improved working capital metrics and liquidity

- Extended payment cycles without supplier pushback

- Stronger supplier relationships and reduced disruption risk

- Transparent and auditable invoice flows

- Alignment with ESG goals through MSME support

As the demands of modern finance evolve, traditional supply chain financing is being augmented by solutions such as DTX (Dynamic Transaction Exchange). Integrated with platforms like TReDS, DTX gives buyers more nuanced control over payment timelines, without compromising on supplier liquidity.

With DTX, buyers can:

- Adjust timing of payments dynamically based on internal cash flows

- Avoid the rigidity of static payment schedules

- Enable suppliers to receive payments promptly, with less dependence on bank credit

This allows reverse factoring to function not just as a payment tool, but as an integrated liquidity management lever.

Why It Matters for Suppliers, Especially MSMEs

Suppliers—many of them MSMEs—often operate with limited working capital. Delays in payments from buyers can strain their operations or push them toward expensive short-term credit.

Through reverse factoring on TReDS, suppliers benefit from:

- Faster access to funds once invoices are approved

- No need for collateral or high credit scores

- Financing based on buyer’s creditworthiness

- Predictable cash flow for managing day-to-day operations

This strengthens the entire supply chain, ensuring suppliers can fulfil future orders and grow sustainably.

Benefits of Reverse Factoring with TReDS

| For Buyers | For Suppliers (MSMEs) |

| Extend payables without damaging relationships | Get paid early at competitive rates |

| Optimise working capital and liquidity planning | Avoid expensive debt and improve cash flow |

| Transparent digital audit trails | Easy access to finance without collateral |

| Strengthen supplier ecosystems | Grow sustainably with steady working capital |

| Leverage DTX for flexible liquidity management | Focus on operations instead of collections |

Conclusion

Reverse factoring, powered by digital platforms like TReDS and enhanced through tools such as DTX, is reshaping how businesses manage cash flow across the supply chain. For buyers, it offers control and flexibility over working capital. For suppliers, it delivers timely funding without increasing their debt burden.

As India’s B2B finance ecosystem evolves, embracing reverse factoring through platforms like TReDS is proving to be a strategic move—not just a financial transaction.

What is reverse factoring and how is it different from traditional factoring?

Reverse factoring is a supply chain finance solution initiated by the buyer rather than the supplier. Unlike traditional factoring where suppliers seek financing, reverse factoring enables buyers to approve invoices early, allowing financiers to offer early payments to suppliers at competitive rates. This reduces supplier credit risk and financing costs while improving buyer relationships.

How does reverse factoring work on the TReDS platform?

On the TReDS platform, after a supplier uploads an invoice, the buyer approves it digitally. Then, multiple financiers bid to provide early payment to the supplier. Following this, the supplier chooses the best bid and receives prompt payment, while the buyer pays the financier on the original invoice due date, helping manage cash flow efficiently.

What are the benefits of reverse factoring for buyers and suppliers?

Buyers benefit from extended payment terms, optimized working capital, and stronger supplier relationships. Suppliers gain early access to funds, reduced credit risk, and lower financing costs. Overall, reverse factoring promotes supply chain stability and business growth.

Are there risks in reverse factoring and how are defaults managed?

Reverse factoring through DTX is designed to minimise risk for all parties. Once the buyer accepts an invoice on the platform (creating a Factoring Unit), they commit to pay the financier on the due date. This makes the transaction non-recourse to the seller, meaning the supplier isn’t liable in case of default.

Financiers assess the buyer’s credit profile before bidding, and only verified buyers are onboarded. Additionally, DTX is integrated with fraud prevention tools to detect duplicate or fraudulent invoices in real-time.

As a licensed TReDS platform regulated by the RBI, DTX ensures full compliance, transparency, and risk control, so that defaults, if they occur, are managed within a secure and accountable system.

Is reverse factoring with TReDS suitable for all industries and company sizes?

Reverse factoring on TReDS is suitable for various industries, especially those with regular invoice-based transactions and trusted buyer-supplier relationships. While it primarily benefits MSMEs and mid-sized companies, its applicability depends on buyer creditworthiness, transaction volumes, and industry specifics.